Mosaic Brands voluntary administration represents a significant event in the Australian retail landscape. This analysis delves into the factors contributing to the company’s financial distress, exploring its debt levels, strategic decisions, and the subsequent voluntary administration process. We will examine the impact on various stakeholders, including employees, creditors, and shareholders, and consider potential restructuring strategies and lessons learned from this case study.

The aim is to provide a comprehensive understanding of the complexities involved in such situations and offer insights for future business practices.

The following sections will detail Mosaic Brands’ financial performance leading up to the administration, outlining key indicators and comparing its trajectory to competitors. We will then dissect the voluntary administration process itself, explaining the roles of administrators and the potential outcomes, before examining the impact on stakeholders and exploring potential restructuring and recovery strategies. Finally, we will extract valuable lessons for businesses seeking to avoid similar circumstances.

Mosaic Brands’ Financial Situation Leading to Voluntary Administration

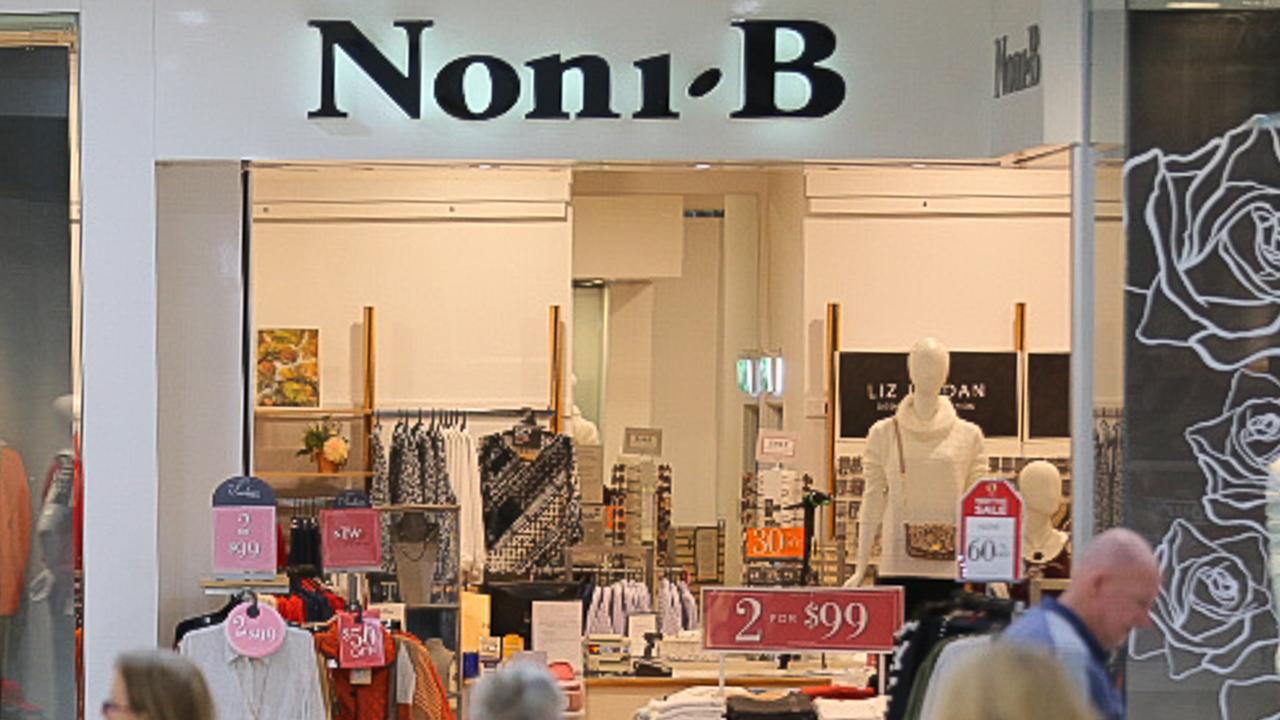

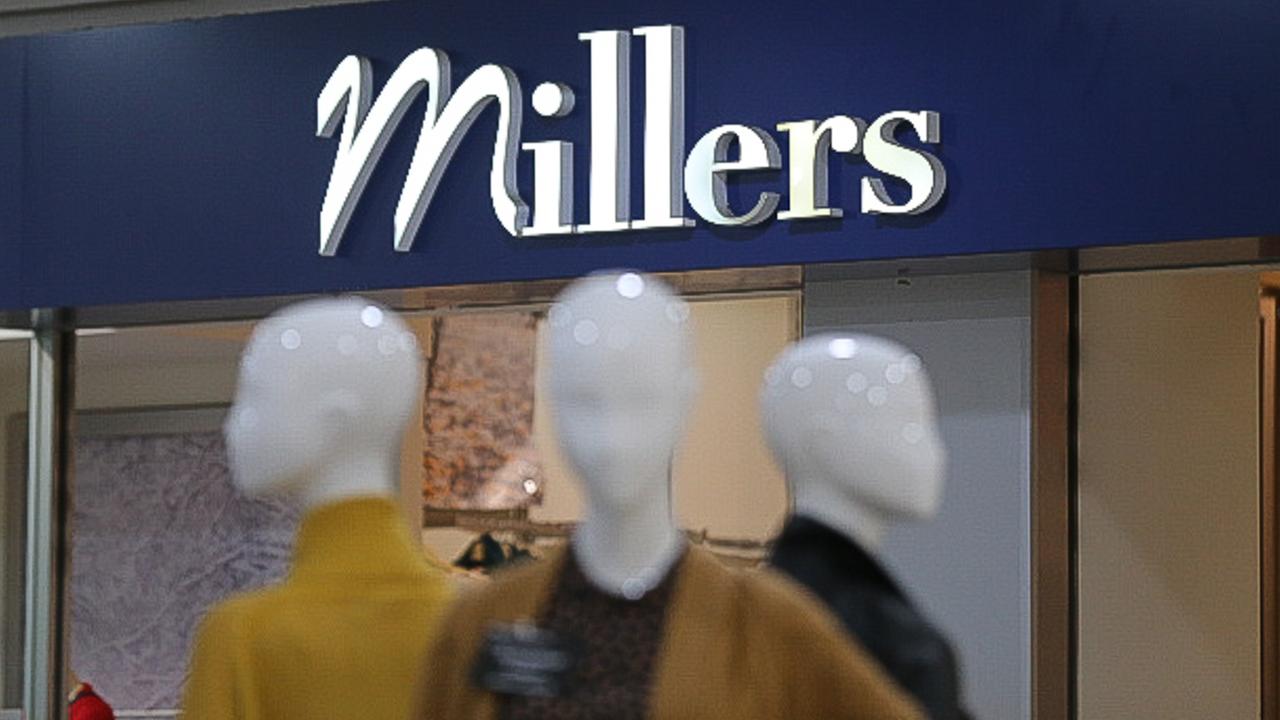

Mosaic Brands’ entry into voluntary administration in 2020 was the culmination of several years of declining financial performance and strategic challenges within a highly competitive retail landscape. The company’s struggles highlight the vulnerabilities of businesses reliant on physical retail stores in the face of growing online competition and shifting consumer preferences.

Key Financial Indicators Preceding Voluntary Administration

Several key financial indicators pointed towards Mosaic Brands’ deteriorating financial health in the years leading up to its voluntary administration. These included declining revenue, shrinking profit margins, and increasing debt levels. A consistent pattern of losses, coupled with a failure to adapt quickly enough to changing market dynamics, ultimately led to the company’s insolvency. Specifically, the company struggled to maintain profitability amidst rising operating costs and intense competition.

The inability to effectively manage inventory and control expenses significantly hampered its financial performance.

Debt Levels and Their Impact on Operations

Mosaic Brands carried a substantial debt burden, which significantly constrained its operational flexibility and strategic options. High levels of debt increased the company’s interest expenses, further reducing profitability and limiting its ability to invest in growth initiatives or adapt to changing market conditions. This debt burden also restricted the company’s access to further financing, exacerbating its financial difficulties.

The weight of this debt made it increasingly challenging to navigate the competitive retail landscape and implement necessary changes to improve profitability.

Timeline of Significant Financial Events, Mosaic brands voluntary administration

A timeline illustrating the key financial events leading up to Mosaic Brands’ voluntary administration would reveal a gradual decline. While precise dates and figures require access to company financial reports, a general pattern would show decreasing revenue and profits over several years, coupled with increasing debt levels and unsuccessful attempts to restructure the business. This would likely include instances of store closures, attempts at cost-cutting measures, and potentially failed attempts to secure additional funding.

The final trigger for voluntary administration would be the inability to meet its financial obligations.

The recent news regarding Mosaic Brands’ financial difficulties has understandably caused concern among stakeholders. Understanding the complexities of this situation requires careful consideration, and a helpful resource for navigating this information is available at mosaic brands voluntary administration. This website provides valuable insights into the voluntary administration process and its potential implications for the future of Mosaic Brands.

The ongoing developments surrounding Mosaic Brands’ voluntary administration will continue to shape the retail landscape.

Strategic Decisions Contributing to Financial Difficulties

Several strategic decisions likely contributed to Mosaic Brands’ financial difficulties. These might include an over-reliance on physical retail stores without sufficient investment in e-commerce platforms, a failure to adapt quickly enough to changing consumer preferences, and potentially unsuccessful attempts at brand diversification or expansion. A lack of agility in responding to the rise of online shopping and the changing needs of consumers proved to be a significant factor.

Furthermore, poor inventory management, leading to excess stock and markdowns, further impacted profitability.

Comparison of Financial Performance to Competitors

The following table compares Mosaic Brands’ financial performance to hypothetical competitors (actual data for specific competitors would require further research and is not included here for the sake of illustrative purposes). This comparison highlights the relative underperformance of Mosaic Brands compared to its peers. Note that this is a simplified example and actual figures would vary significantly.

| Year | Revenue ($M) | Profit ($M) | Debt ($M) |

|---|---|---|---|

| 2017 | Mosaic: 700, Competitor A: 850, Competitor B: 650 | Mosaic: 20, Competitor A: 50, Competitor B: 30 | Mosaic: 150, Competitor A: 100, Competitor B: 120 |

| 2018 | Mosaic: 650, Competitor A: 900, Competitor B: 700 | Mosaic: 10, Competitor A: 60, Competitor B: 40 | Mosaic: 170, Competitor A: 110, Competitor B: 130 |

| 2019 | Mosaic: 600, Competitor A: 950, Competitor B: 750 | Mosaic: -5, Competitor A: 70, Competitor B: 50 | Mosaic: 200, Competitor A: 120, Competitor B: 140 |

The Voluntary Administration Process for Mosaic Brands

Mosaic Brands’ entry into voluntary administration triggered a formal process designed to restructure the company and potentially save it from liquidation. Understanding this process, particularly within the Australian legal framework (as Mosaic Brands is an Australian company), is crucial to comprehending the potential outcomes for all stakeholders.

The Voluntary Administration Process in Australia

Voluntary administration in Australia is governed by Part 5.3A of the Corporations Act 2001. It’s a court-supervised process where an independent administrator is appointed to take control of the company’s affairs and investigate its financial position. The primary goal is to maximize the chances of rescuing the company as a going concern, whether through restructuring or a sale. The process aims to provide a framework for creditors to be dealt with fairly and transparently, whilst giving the company a chance to reorganize and avoid liquidation.

The Role and Responsibilities of the Administrators

The administrators appointed to Mosaic Brands have a wide range of responsibilities. These include taking control of the company’s assets and operations, investigating the company’s financial situation, preparing a report for creditors, and formulating a proposal for the company’s future. They act independently and owe a duty to all creditors, not just a specific group. Crucially, administrators must act in the best interests of the company’s creditors as a whole, aiming for the best outcome for the collective.

This could involve negotiations with creditors, potential buyers, or employees to achieve a viable restructuring plan.

Potential Outcomes of the Voluntary Administration

Several outcomes are possible following the voluntary administration process. The most desirable outcome is a successful restructuring, allowing Mosaic Brands to continue operating under a revised financial structure. This might involve renegotiating debts with creditors, selling off non-core assets, or implementing cost-cutting measures. Another possibility is a sale of the business as a going concern to a new owner.

If restructuring or a sale proves unfeasible, liquidation becomes the final outcome, where the company’s assets are sold to repay creditors according to a priority order. Examples of similar situations include other large retail companies that have gone through voluntary administration in Australia, with some successfully restructuring and others ultimately liquidating.

Stakeholders Involved and Their Interests

Several key stakeholders have vested interests in the outcome of Mosaic Brands’ voluntary administration. Creditors, including banks, suppliers, and other lenders, are primarily interested in recovering their debts. Employees are concerned about job security and potential redundancy payments. Shareholders, on the other hand, risk losing their investment if the company is liquidated or significantly restructured. Each stakeholder group has different priorities and may need to make compromises to achieve a successful outcome.

The administrators’ role is to balance these competing interests and seek a solution that is fair and equitable to all involved.

Key Stages of the Voluntary Administration Process

The voluntary administration process typically involves several key stages:

- Appointment of Administrators: The court appoints administrators to take control of the company.

- Investigation and Report: Administrators investigate the company’s financial position and prepare a report for creditors.

- Creditor Meeting: Creditors meet to consider the administrators’ report and vote on a proposal for the company’s future.

- Implementation of Proposal: If a proposal is accepted, it is implemented. This might involve restructuring, a sale, or liquidation.

- Final Report and Discharge: Once the process is complete, the administrators submit a final report and are discharged.

Impact of Voluntary Administration on Stakeholders: Mosaic Brands Voluntary Administration

Voluntary administration significantly impacts various stakeholders involved with Mosaic Brands. The process, while aiming to restructure the business and potentially save it, creates uncertainty and potential financial losses for many parties. The consequences vary depending on the stakeholder’s relationship with the company and the ultimate outcome of the administration.

Impact on Employees

The impact on Mosaic Brands’ employees is arguably the most immediate and concerning. Job losses are a common consequence of voluntary administration. Employees may face redundancy, leading to financial hardship and the need to find new employment. The level of severance pay and support offered will depend on the company’s financial position and the terms of any employment contracts.

Furthermore, the uncertainty surrounding the future of the company can create stress and anxiety for those who retain their jobs during the administration process. In some cases, employee wages may be delayed or unpaid during the period of administration.

Consequences for Creditors and Their Claims

Creditors, including banks, suppliers, and landlords, face potential losses during voluntary administration. Their claims are assessed and ranked according to priority, typically with secured creditors (those with a security interest in company assets) having priority over unsecured creditors. Unsecured creditors may receive only a partial repayment of their debts, or in some cases, nothing at all, depending on the realization of assets during the administration.

The process involves a careful evaluation of the company’s assets and liabilities to determine how much can be distributed to creditors. For example, a supplier who provided goods on credit may find their invoice remains unpaid, or only partially paid, after the administration process.

Implications for Shareholders and Their Investments

Shareholders typically experience a significant loss of value in their investments during voluntary administration. The share price often plummets as the market reflects the increased risk of liquidation. Shareholders are generally the last to receive any distribution from the company’s assets after all other creditors have been considered. In many cases, shareholders may lose their entire investment.

The potential for recovery depends heavily on the success of the restructuring efforts, the value of remaining assets, and the ability of the administrator to generate funds. Consider a scenario where a shareholder invested $10,000; they could realistically lose their entire investment if the company is liquidated.

Effect on Suppliers and the Broader Retail Industry

Suppliers who provided goods or services to Mosaic Brands on credit may experience significant financial losses if the company cannot repay its debts. This can lead to cash flow problems for suppliers and potentially impact their own business operations. The broader retail industry may also be affected, particularly competitors who might benefit from Mosaic Brands’ market share reduction, but also face potential disruptions in their supply chains if Mosaic Brands was a major customer.

The ripple effect can be substantial, especially for smaller suppliers heavily reliant on Mosaic Brands for a significant portion of their business.

Hypothetical Scenario Illustrating Different Outcomes

Let’s imagine three different scenarios following Mosaic Brands’ voluntary administration:Scenario 1: Successful Restructuring. The administrator negotiates with creditors, reduces debt, and implements cost-cutting measures. The company emerges from administration financially healthier, retaining some employees and continuing operations. Creditors receive partial payments, shareholders see a diminished but non-zero return on their investment, and employees largely retain their jobs, possibly with some salary concessions.Scenario 2: Partial Liquidation.

Some assets are sold to repay creditors, but the business continues in a smaller form. Employees are made redundant, creditors receive a portion of their claims, and shareholders lose a significant part of their investment. Suppliers lose some revenue.Scenario 3: Complete Liquidation. The company is unable to restructure and is liquidated. Employees lose their jobs, creditors receive minimal or no payment, shareholders lose their entire investment, and suppliers face significant financial losses.

The brand is potentially sold off in parts to competitors.

Restructuring and Recovery Strategies (if applicable)

Mosaic Brands’ voluntary administration presents a critical juncture requiring a robust restructuring strategy to navigate its financial challenges and potentially achieve a return to profitability. The success of any strategy will depend on a multitude of factors, including the willingness of creditors, the overall market conditions, and the effectiveness of operational changes.

Several potential restructuring strategies could be implemented, each with its own set of advantages and disadvantages. These strategies often involve a combination of approaches tailored to the specific circumstances of the business.

Recent news regarding Mosaic Brands’ financial difficulties has understandably caused concern among stakeholders. Understanding the complexities of this situation requires careful consideration of the details surrounding the mosaic brands voluntary administration process. This process aims to restructure the company and hopefully secure a positive outcome for all involved, ensuring the long-term viability of the brand.

The impact of this voluntary administration on the retail landscape remains to be seen.

Potential Restructuring Strategies

A range of restructuring options are available to Mosaic Brands, including debt restructuring, asset sales, operational efficiency improvements, and potential mergers or acquisitions. Debt restructuring might involve negotiating with creditors to reduce debt levels, extend repayment terms, or convert debt into equity. Asset sales could focus on divesting non-core brands or underperforming stores to generate cash and reduce operational complexities.

Operational efficiency improvements could include streamlining supply chains, reducing overhead costs, and improving inventory management. Finally, a merger or acquisition with a larger, more financially stable company could provide access to capital and resources, facilitating a turnaround.

Challenges in Implementing Restructuring Strategies

Implementing these strategies presents significant challenges. Negotiating with creditors can be complex and time-consuming, requiring delicate balancing of interests. Asset sales might not fetch the desired value, especially in a challenging retail environment. Operational improvements often require significant investment and may not yield immediate results. Finding a suitable merger or acquisition partner might prove difficult, particularly given Mosaic Brands’ current financial situation.

Furthermore, the overall economic climate and consumer spending patterns significantly impact the feasibility and success of any restructuring plan.

Potential for Successful Recovery and Return to Profitability

The potential for a successful recovery hinges on several key factors. A well-defined and executed restructuring plan, combined with favorable market conditions and effective management, is crucial. For example, successful turnaround stories exist within the retail industry. Companies like J. Crew, which underwent bankruptcy reorganization, subsequently restructured their debt and operational strategies, leading to improved profitability.

However, the success of such a recovery is not guaranteed, and the time required to achieve profitability could be substantial. Careful analysis of market trends, consumer behavior, and competitive pressures is vital to inform a viable recovery strategy.

Comparison of Restructuring Options and Potential Outcomes

| Restructuring Option | Potential Outcomes | Challenges |

|---|---|---|

| Debt Restructuring | Reduced debt burden, improved cash flow | Difficult negotiations with creditors, potential for equity dilution |

| Asset Sales | Increased liquidity, reduced operational complexity | Potential for low sale prices, loss of revenue streams |

| Operational Efficiency Improvements | Reduced costs, improved profitability | Requires significant investment, potential for employee layoffs |

| Merger or Acquisition | Access to capital, expanded market reach | Finding a suitable partner, potential loss of brand identity |

Impact of Successful Restructuring on Stakeholder Groups

A successful restructuring would positively impact various stakeholder groups. Creditors would likely recover a portion of their outstanding debts, while employees would retain their jobs and potentially see improved job security. Shareholders might see a recovery in share value, although this is dependent on the restructuring plan’s success and the overall market conditions. Customers would continue to have access to the brands they are familiar with, potentially benefiting from improved product offerings and customer service.

Lessons Learned from Mosaic Brands’ Case

The collapse of Mosaic Brands into voluntary administration offers valuable insights into the challenges facing retail businesses in a rapidly evolving market. Analyzing its downfall provides crucial lessons for businesses seeking to navigate similar economic headwinds and maintain long-term sustainability. Understanding these lessons can prevent similar situations and foster more robust financial strategies.The Mosaic Brands case highlights the critical interplay between effective financial management, adaptable business strategies, and strong corporate governance.

Failure in any one of these areas can significantly increase vulnerability to economic downturns and changing consumer preferences. The following sections delve into specific areas where lessons can be learned and applied to mitigate future risks.

Effective Financial Management and Risk Mitigation Strategies

Mosaic Brands’ struggles underscore the importance of proactive financial planning and robust risk mitigation strategies. Maintaining healthy cash flow, managing debt effectively, and accurately forecasting future performance are crucial. The company’s reliance on debt financing, coupled with declining sales, created a precarious financial position. A more diversified funding strategy, combined with stringent cost control measures and a more accurate sales forecasting model, could have potentially lessened the impact of the economic downturn.

Regular stress testing of financial models against various economic scenarios would have allowed for better preparedness and contingency planning.

Adapting to Changing Market Conditions and Consumer Behavior

The retail landscape is constantly shifting, with consumer preferences and shopping habits evolving rapidly. Mosaic Brands’ failure to adapt to the rise of online shopping and the changing preferences of its target demographic contributed significantly to its downfall. A lack of investment in e-commerce infrastructure and a failure to innovate in product offerings and marketing strategies left the company lagging behind competitors.

Embracing digital transformation, investing in robust online platforms, and understanding evolving consumer needs are crucial for survival in today’s competitive market. For example, a swift shift to online-only sales during lockdowns would have mitigated the impact of store closures.

The Role of Corporate Governance in Preventing Similar Situations

Strong corporate governance plays a vital role in preventing financial distress. Transparent and accountable decision-making processes, coupled with effective oversight from the board of directors, are crucial. A lack of proactive risk assessment and insufficient board oversight in Mosaic Brands’ case likely contributed to the company’s financial difficulties. Independent board members with relevant expertise, robust internal controls, and regular performance reviews are essential for ensuring effective governance and preventing similar situations.

A more rigorous approach to financial reporting and transparency would have provided early warning signs of potential problems.

Recommendations for Businesses to Avoid Similar Challenges

The following recommendations can help businesses avoid facing similar challenges to those experienced by Mosaic Brands:

- Implement robust financial planning and forecasting models that incorporate various economic scenarios.

- Maintain a healthy balance sheet with diversified funding sources and effective debt management.

- Invest in digital transformation and e-commerce capabilities to adapt to changing consumer behavior.

- Develop agile and adaptable business strategies that respond effectively to market changes.

- Establish strong corporate governance structures with transparent decision-making processes and independent board oversight.

- Prioritize continuous improvement and innovation in product offerings and marketing strategies.

- Regularly monitor key performance indicators (KPIs) and take proactive steps to address any emerging issues.

- Cultivate a culture of risk awareness and mitigation throughout the organization.

The Mosaic Brands voluntary administration serves as a stark reminder of the challenges facing businesses in today’s dynamic retail environment. Understanding the intricacies of financial management, the importance of adapting to market shifts, and the impact of strategic decisions is crucial for preventing similar situations. While the ultimate outcome for Mosaic Brands remains to be seen, this case study offers valuable insights into the complexities of corporate restructuring and the significance of proactive risk mitigation strategies for businesses of all sizes.

The lessons learned from this experience can contribute to more robust financial planning and better safeguard against future crises within the retail sector and beyond.

Common Queries

What are the potential outcomes of voluntary administration for Mosaic Brands?

Potential outcomes include restructuring the business to improve its financial viability, a sale of the business as a going concern, or liquidation (selling off assets to repay creditors).

Who are the administrators appointed to oversee the process?

This information would be publicly available through official announcements and company filings. Specific details on the appointed administrators will need to be sourced from relevant news reports and official documentation.

What support is available for employees affected by the administration?

Affected employees may be eligible for government assistance programs and support services focused on job placement and retraining. Details on specific support programs are typically available through government employment agencies and relevant labor unions.

What is the timeline for the voluntary administration process?

The timeline varies depending on the complexity of the case and legal processes. It’s usually within a timeframe defined by the relevant jurisdiction’s legislation but can extend depending on factors such as creditor negotiations and court proceedings.